The Provincial Board of Revenue Pakistan is a vital government institution responsible for the administration of land revenue, property registration, and land reforms across Pakistan’s provinces, including Punjab, Sindh, Khyber Pakhtunkhwa (KP), and Balochistan. These boards play a central role in managing the country’s land record system, collecting revenue, and facilitating legal land transactions. With the increasing push toward digital governance, the Boards of Revenue have adopted innovative systems to improve transparency, efficiency, and public access to land-related services.

Overview of the Provincial Board of Revenue

The Provincial Board of Revenue is the apex revenue authority at the provincial level, overseeing land revenue, tenancy records, property mutation, and associated fiscal functions. It ensures proper documentation of land ownership, enforces land laws, and facilitates dispute resolution related to land rights.

Historical Background and Constitutional Status

Originating from the colonial British administrative framework, the Boards of Revenue were established to manage agrarian revenues and maintain orderly land records. Post-independence, each province retained its own Board under the constitutional mandate to handle land revenue autonomously.

Key Departments and Their Functions

- Revenue Department: Collection of land taxes and stamp duties.

- Land Records Department: Maintenance of land ownership and cadastral data.

- Settlement and Consolidation: Management of land partition and dispute resolution.

- Legal Wing: Interpretation and enforcement of land laws.

Roles and Responsibilities

Following are the roles and responsibilities

Revenue Collection and Land Records Management

The core function includes assessing and collecting land revenue, agricultural income tax, and stamp duty. Boards maintain and update records of ownership to reflect accurate landholding patterns.

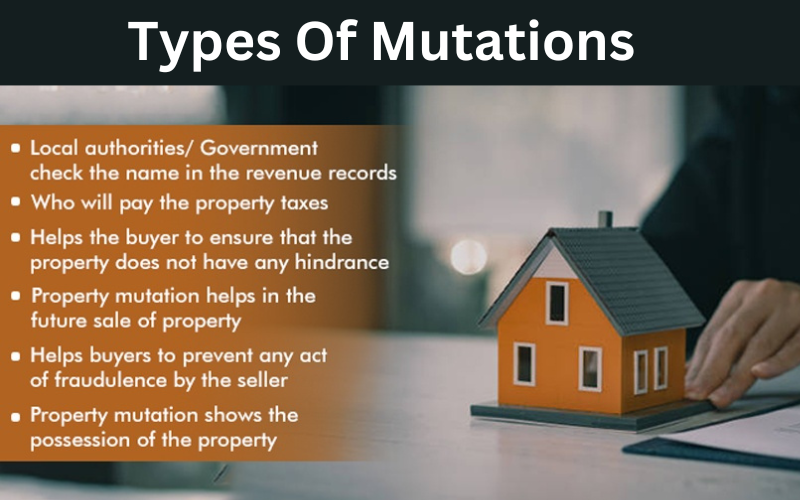

Mutation and Registration Processes

Boards process property mutation—a legal change of ownership title—based on sale, inheritance, or transfer. They also oversee the registration of property deeds and contracts.

Enforcement of Land Reforms

The Boards play an instrumental role in implementing land reforms, such as ceiling limits on landholding and redistribution policies, to promote equity and eliminate feudal monopolies.

Legal Jurisdiction and Dispute Resolution

They provide quasi-judicial forums for resolving disputes concerning boundaries, inheritance, tenancy, and other land rights through Revenue Courts and appellate authorities.

Provincial Variations

Board of Revenue Punjab

Punjab leads in digitization with its Land Record Management Information System (LRMIS), offering online Fard (ownership record), mutation tracking, and property maps.

Board of Revenue Sindh

Sindh has developed online services for property registration, tax payments, and issuing property certificates via its own portal.

Board of Revenue Khyber Pakhtunkhwa

KP has launched the Digital Land Record System under the Khyber Pakhtunkhwa Land Record Authority to modernize land management.

Board of Revenue Balochistan

While relatively behind in digital transition, Balochistan has initiated reforms in manual land record keeping and is progressing toward digitization.

Public Services and Citizen Interaction

How Citizens Can Access Services

- Visit provincial revenue offices

- Use helplines and complaint redressal centers

- Access mobile facilitation vans in rural areas

Online Portals

- Punjab Zameen Portal (lrmis.punjab-zameen.gov.pk)

- Sindh Board of Revenue Online Services

- KP Revenue Authority Online Access

Transparency and Anti-Corruption Measures

- Introduction of biometric verification systems

- Real-time transaction updates

- Automated tracking of application status to reduce bribes and delays

Challenges and Reforms

Issues in Land Disputes, Outdated Records, and Bureaucracy

- Prevalence of informal landholdings

- Forgery of documents and double registrations

- Resistance from local bureaucracies to digital reforms

Government Initiatives for Digitization and Transparency

- Integration with NADRA for identity validation

- Partnerships with World Bank for land record reform

- Establishment of Digital Service Centers at tehsil levels

FAQs

How to check land ownership online in Punjab through Board of Revenue?

Visit the LRMIS Punjab portal, enter your CNIC and district, and retrieve your property ownership record (Fard) online.

What is the role of the Provincial Board of Revenue in property mutation?

It oversees the legal process of transferring land ownership, verifies documents, and updates land records accordingly.

Can I access land records in Sindh online?

Yes, the Sindh Board of Revenue portal provides services like record search, tax payment, and mutation tracking.

Are there any fees for checking land records online?

Most services are either free or charge nominal government-fixed service fees.

How can I file a complaint against land record officials?

Each province has dedicated complaint cells or portals. For example, Punjab’s Anti-Corruption Complaint System allows online submissions.

What documents are required for property registration?

Typically includes sale deed, CNIC copies, mutation certificate, tax receipts, and attested photographs of both parties.

Is biometric verification mandatory for land transactions?

Yes, in most provinces, biometric verification is now mandatory to curb impersonation and fraud.

Leave a Reply