What We Cover

What Makes Us Different

At Land SolvedIn, we don’t just publish content — we solve real problems faced by landowners, buyers, and citizens dealing with Pakistan’s complex property system. Here’s why thousands trust us:

Expert-Curated Knowledge

Our guides are written and reviewed by legal researchers and property professionals who understand Pakistan’s land laws inside and out.

Region-Specific Accuracy

We focus on provincial land systems whether it’s Punjab’s PLRA, Sindh’s Board of Revenue, or KP’s local records so you get guidance that actually applies to your region.

Updated with Real Cases & Laws

We stay current with new regulations, policy changes, and real-life user challenges to ensure our content remains relevant and actionable.

Are You Stuck in Your Land Matters?

Property disputes, unclear titles, or mutation delays can be stressful and confusing. Don’t let land issues hold you back!

Book a 10-minute consultation with our Expert Retired Revenue Officer, get professional guidance, clear your doubts, and understand the next steps for resolving your land concerns.

Blogs

Who Pays Stamp Duty in Pakistan? Understanding the Real Estate Cost Burden in 2025

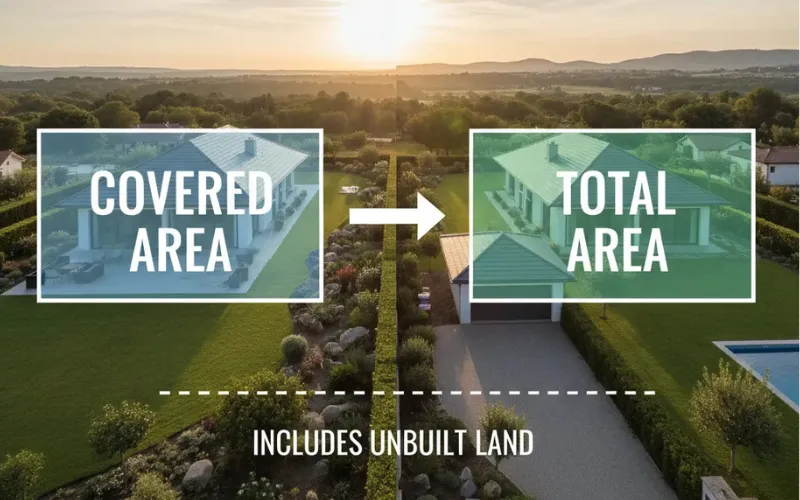

Covered Area vs Total Area in Property: Understanding What Really Counts

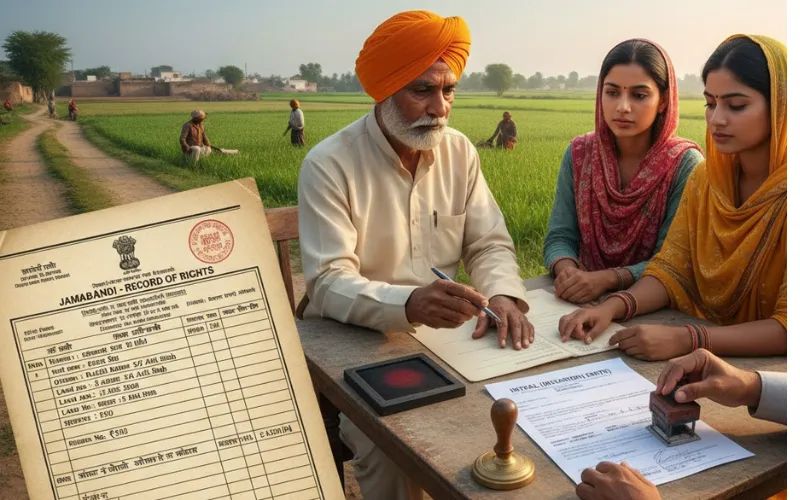

Difference Between Jamabandi and Intkal

Compulsory Heirs in Pakistan: Inheritance Law Guide

How to Check Land Ownership in Pakistan

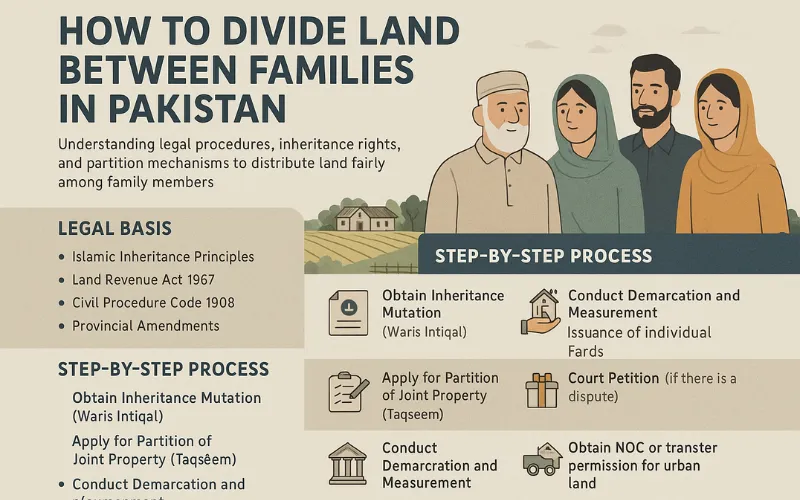

How to Divide Land Between Families in Pakistan

Free Land Documentation Checklist (PDF)

Download our expert-made checklist to avoid documentation mistakes during buying, selling, or registering property

FREQUENTLY ASKED QUSTIONS

Yes, we offer expert consultations for property-related legal queries, registration issues, land disputes, and document guidance in Pakistan.

Yes, we provide region-specific content and resources tailored for Punjab, Sindh, KP, and Balochistan. Our guides reference the correct land records systems (e.g., PLRA, Sindh BOR) used in each province.

No, LandSolvedIn is an independent educational platform. We provide legally reviewed guides and expert-curated content to help citizens navigate land-related processes, but we are not affiliated with any government department.