-

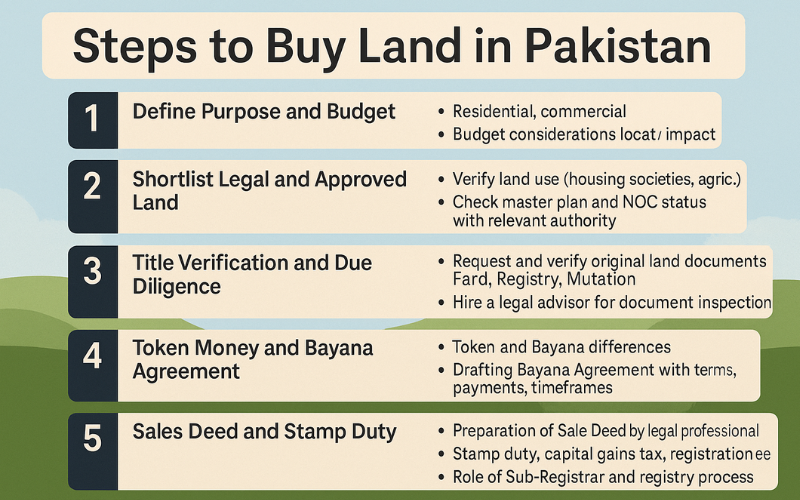

Steps to Buy Land in Pakistan: Complete 2025 Guide for First-Time Buyers

The real estate sector in Pakistan continues to attract strong interest from locals, overseas Pakistanis, and investors alike. Whether you’re looking to build your dream home, start a commercial project, or invest in agricultural land,…

-

How to Get a Map Approved for House Construction in Pakistan

Building a house in Pakistan is not just about laying bricks and mortar—it begins with map approval, a legal prerequisite enforced by municipal authorities. Whether you’re constructing a single-family home or a multi-storey residence, securing…

-

Property Tax Rates in Pakistan 2025 | Full Guide

Property tax is a recurring financial obligation imposed by local governments on real estate assets, including land and buildings. It serves as a vital revenue source for municipal development, infrastructure, and public services. The year…

-

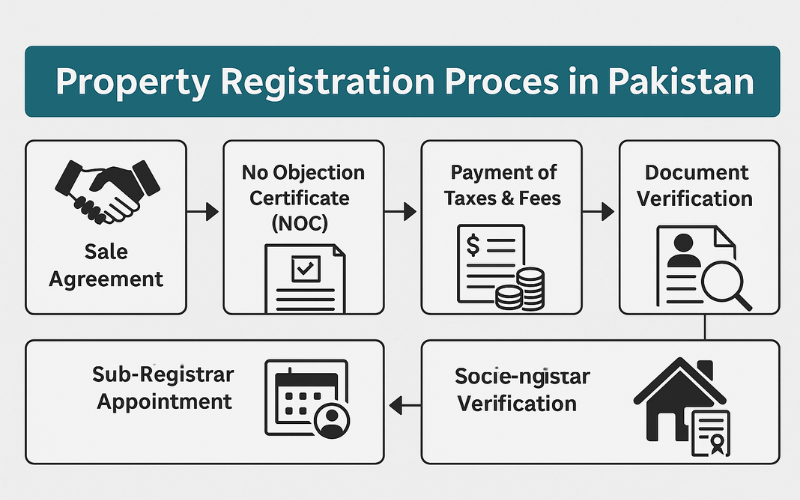

Property Registration Process in Pakistan: Step-by-Step Guide (2025)

Buying property is a major investment—but without proper registration, your ownership rights may not be legally protected. Whether you’re a first-time buyer, an overseas Pakistani, or a real estate investor, this guide breaks down the…

-

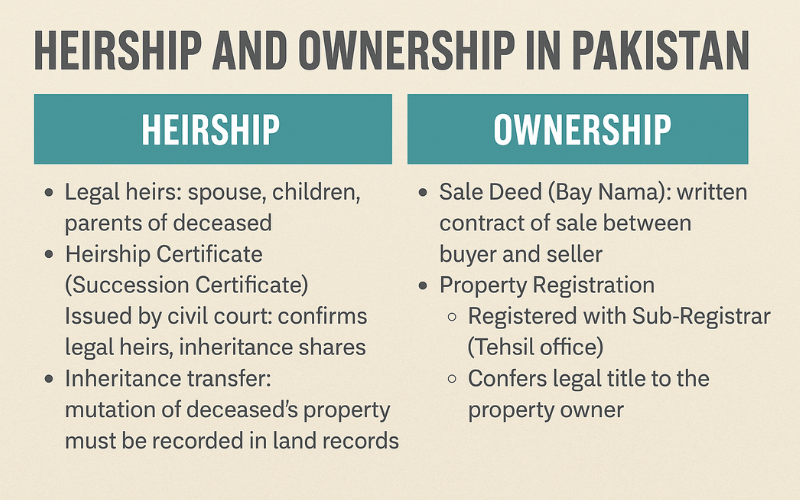

Difference Between Heirship and Ownership in Pakistan

Understanding the difference between heirship and ownership is crucial for anyone dealing with property inheritance in Pakistan. While both terms are often used interchangeably in casual conversations, they have distinct legal meanings under Pakistani property…

-

Fraud and Manual Errors in Property Records: Legal Risks and Prevention

In Pakistan’s fast-evolving real estate landscape, accurate property records are not just paperwork—they are the foundation of secure land ownership, legal rights, and economic stability. Whether you’re buying land, inheriting a plot, or resolving disputes,…

-

Stamp Duty in Pakistan – 2025 Expert Guide

Stamp Duty is a pivotal component of property transactions in Pakistan, serving as a legal validation of ownership and a significant revenue source for provincial governments. As of 2025, understanding the nuances of Stamp Duty…