Stamp Duty is a pivotal component of property transactions in Pakistan, serving as a legal validation of ownership and a significant revenue source for provincial governments. As of 2025, understanding the nuances of Stamp Duty is essential for property buyers, sellers, and investors to ensure compliance and optimize financial planning.

What is Stamp Duty?

Stamp Duty is a tax levied on legal documents, particularly those related to the transfer of immovable property. Originating from colonial legislation, it is primarily governed by the Stamp Act of 1899, with provinces authorized to set specific rates and procedures.

Purpose and Government Revenue Angle

Beyond legitimizing property transactions, Stamp Duty contributes substantially to provincial revenues, funding infrastructure and public services. It also aids in maintaining transparent property records, reducing disputes over ownership.

Stamp Duty in Pakistan – 2025 Updates

Following are the current updates

Current Slab Rates and Thresholds

Stamp Duty rates in Pakistan vary by province and the nature of the property transaction. As of 2025, the following rates are applicable:

- Punjab: 1% of the property’s declared value for registration purposes.

- Sindh: Rates vary based on property type and location; users should consult the Sindh Board of Revenue for specifics information

- Khyber Pakhtunkhwa (KP): 1% Stamp Duty for the fiscal year 2024-25.

- Islamabad Capital Territory (ICT): Follows federal guidelines; specific rates may vary.

Changes Announced in 2025 Budget or Legislation

Recent legal developments include the Lahore High Court’s suspension of Stamp Duty on corporate mergers in Punjab, aligning with exemptions in Sindh and Islamabad. Additionally, discussions are underway to standardize Stamp Duty rates across provinces to streamline property transactions.

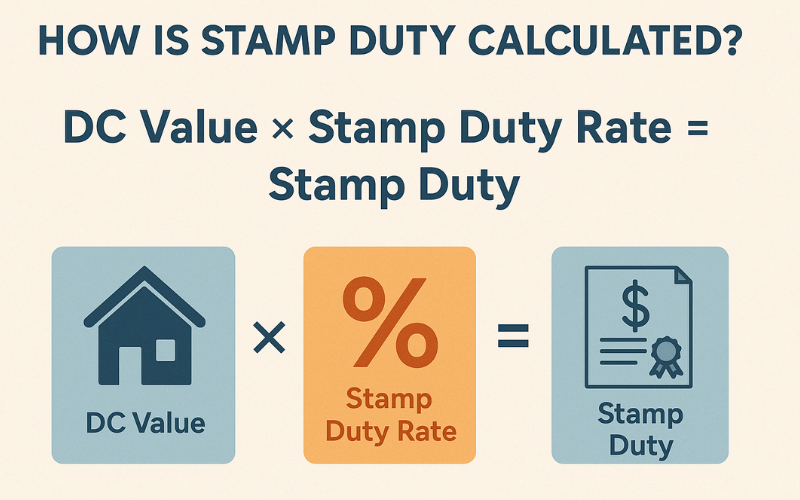

How is Stamp Duty Calculated?

Example Calculation

Stamp Duty is typically calculated as a percentage of the property’s DC (Deputy Collector) value, which is the government’s assessed value of the property.

Example: If a property’s DC value is PKR 10,000,000 and the applicable Stamp Duty rate is 1%, the Stamp Duty payable would be:

PKR 10,000,000 × 1% = PKR 100,000

Online Tools or Government Portals for Checking Stamp Duty

Who Pays Stamp Duty & When?

Buyer/Seller Obligations

In Pakistan, the buyer is generally responsible for paying Stamp Duty at the time of property registration. The seller may be liable for other taxes, such as Capital Gains Tax, depending on the transaction.

Payment Timelines and Penalties

Stamp Duty must be paid before the execution and registration of the property transfer deed. Failure to pay on time can result in penalties, including fines and legal complications.

Stamp Duty Exemptions and Rebates

For First-Time Buyers, Women, Senior Citizens, Agricultural Land, etc.

Certain exemptions and rebates are available:

- First-Time Buyers: Exempt from Federal Excise Duty (FED) on property purchases.

- Low-Value Properties: Properties valued below specific thresholds may be exempt or subject to reduced rates, varying by province.

- Agricultural Land: Often exempt from Stamp Duty, subject to provincial regulations.

Legal Documentation Required

To claim exemptions or rebates, applicants must provide:

- Valid CNIC

- Proof of eligibility (e.g., first-time buyer affidavit)

- Property valuation documents

- Any additional documents as specified by provincial authorities

Stamp Duty on Different Types of Transactions

Residential vs. Commercial Property

Stamp Duty rates may differ between residential and commercial properties, with commercial properties often attracting higher rates due to their potential for income generation.

Gift Deeds, Lease Agreements, Joint Property, etc.

- Gift Deeds: Subject to Stamp Duty, though rates may be concessional when transferring to immediate family members.

- Lease Agreements: Stamp Duty is calculated based on the lease term and annual rent.

- Joint Property: Stamp Duty is typically divided among co-owners proportionally.

How to Pay Stamp Duty Online in Pakistan

- Access the e-Stamping Portal: Visit the relevant provincial e-Stamping website:

- Punjab

- Sindh

- Generate Challan Form 32-A: Input property details, including location, area, and transaction type.

- Calculate Stamp Duty: Use the built-in calculator to determine the payable amount.

- Submit Payment: Pay the calculated amount at designated bank branches or through online banking, if available.

Leave a Reply