In any country, especially in agricultural economies like Pakistan and India, land records hold paramount importance. The Register of Rights in Land Revenue is the backbone of land administration, ensuring transparency, rightful ownership, and smooth handling of land disputes. Understanding this register is crucial for landowners, tenants, legal experts, and policy-makers.

This detailed guide explains the meaning, significance, types, and preparation of the Register of Rights in Land Revenue.

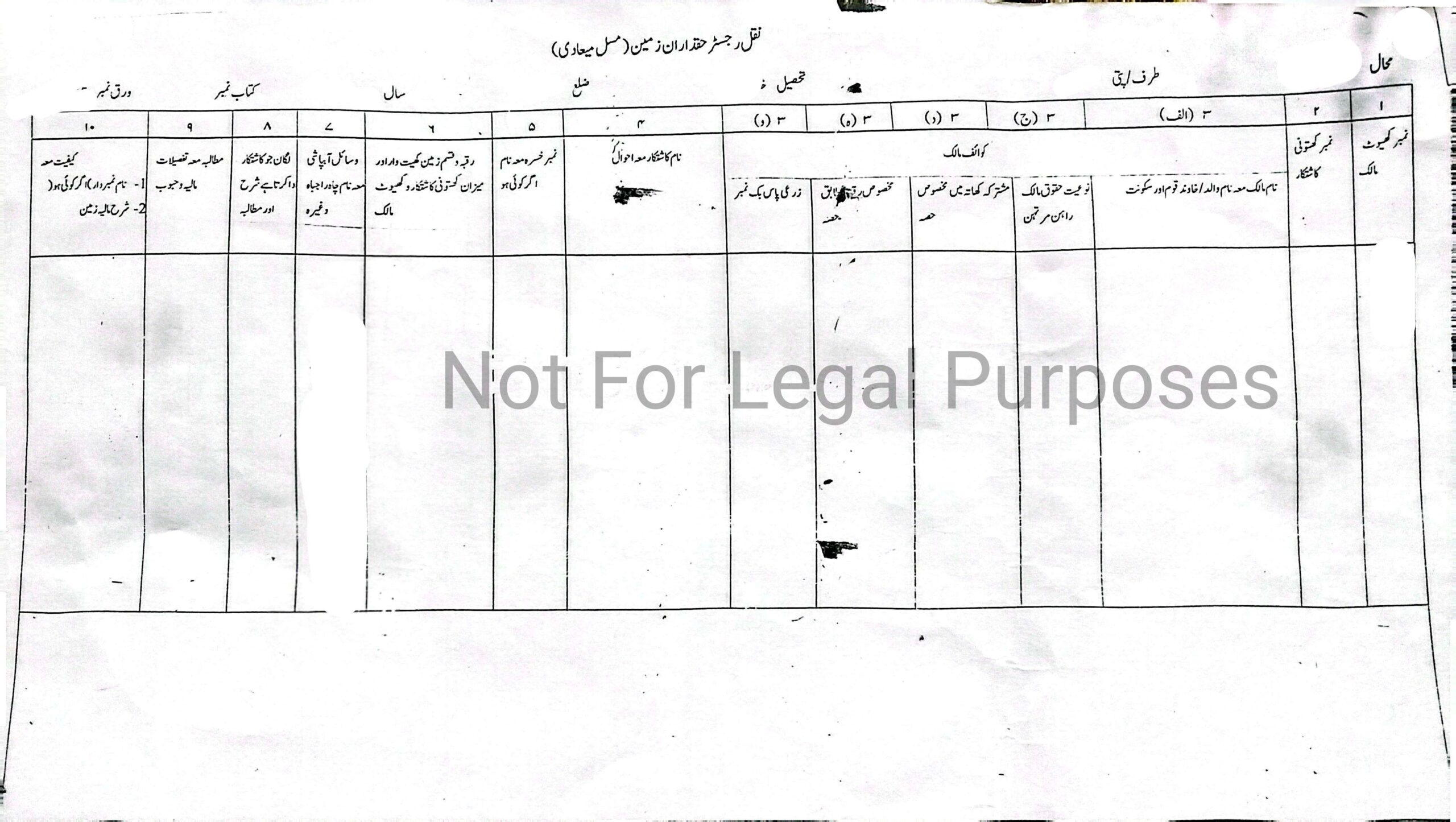

What is the Register of Rights in Land Revenue?

The Register of Rights in Land Revenue is a foundational document in land record systems. It was first introduced in 1887 to systematically document the rights of landowners, tenants, and any other stakeholders with legitimate claims on agricultural land.

This register defines who owns the land, who cultivates it, and who enjoys specific rights over it. Its primary purpose is to maintain accurate, updated records that protect ownership rights and support land revenue collection.

Why is the Register of Rights Important?

Maintaining an updated Register of Rights serves multiple purposes:

- Prevents Land Disputes: Accurate land records reduce ownership conflicts.

- Supports Legal Land Transactions: The register is a legal reference in sales, purchases, or inheritance cases.

- Revenue Collection: Governments rely on it for fair tax assessments.

- Enables Easy Mutations: Timely updating of ownership or land rights is streamlined through this record.

Without it, land ownership can become chaotic, leading to fraudulent claims and revenue losses.

Types of Register of Rights in Land Revenue

There are two major types of Registers of Rights maintained in the land revenue system:

1. Permanent Register of Rights

This is a detailed, once-created record containing essential land information that rarely changes unless significant changes occur. It includes:

- Initial land ownership records

- Land settlement maps

- Details of rights, responsibilities, and limitations of various parties

- Record of landowners, tenants, and khasra (plot) numbers

- Source of income and land usage details

- Maps of rights and irrigation

- Documentation of duties, obligations, and customary practices

2. Periodical Register of Rights (Periodical Record)

This is a regularly updated record, created every four years, to incorporate new ownership changes, tenancy updates, or land usage variations.

According to the Land Revenue Act 1967, Sections 39 and 41, every Patwar circle (smallest land record unit) must prepare this periodic record. Its core purpose is to reflect:

- New ownership after land sales or inheritance

- Updated tenancy or cultivation details

- Recent land transfers (mutations)

- Any structural or usage changes on the land

Mutation Process in Land Records

The mutation process is an integral part of the Register of Rights in Land Revenue. Mutation refers to the legal process of updating the land record when ownership or land usage changes.

For instance:

- After buying land

- Upon inheritance

- In case of land division or partition

- Change in tenant or cultivator

Each mutation must be recorded within 30 days to maintain accuracy and prevent disputes. The Patwari (land record officer) updates the periodical record accordingly.

Guidelines for Updating the Register of Rights

To maintain the accuracy and trustworthiness of the Register of Rights, the following practices are followed:

- The landowners’ list in any Patwar circle must not be older than six months.

- Every change in the periodic record must be verified monthly by the Patwari and authenticated by landowners.

- Re-surveys or khasra number verifications occur after every four years.

Ensuring Accuracy in Land Revenue Records

The Register of Rights in Land Revenue is much more than a government document. It is the legal foundation of land ownership and tenancy rights. Its accuracy impacts not just landowners but also tenants, financial institutions, and legal systems.

With digitalization on the rise, maintaining updated land records has become easier but still requires vigilance from landholders. Timely mutations, regular verification, and awareness of land rights protect individuals from disputes and financial losses.

For farmers, real estate investors, and legal professionals, understanding and regularly checking the Register of Rights in Land Revenue is crucial for safeguarding property rights and ensuring smooth land transactions.

FAQs about Register of Rights in Land Revenue

Q1. How often is the Register of Rights updated?

The Permanent Register is updated when major changes occur, while the Periodical Record is updated every four years or when a mutation happens.

Q2. Who is responsible for maintaining this register?

The Patwari or revenue officials in each area are responsible for maintaining and updating land records.

Q3. Why is mutation important in land records?

Mutation legally transfers ownership in revenue records, making the new owner eligible for government benefits and responsibilities.

Leave a Reply