Buying property is a major investment—but without proper registration, your ownership rights may not be legally protected. Whether you’re a first-time buyer, an overseas Pakistani, or a real estate investor, this guide breaks down the property registration process in Pakistan with step-by-step instructions, legal fees, documents, and government portals.

📌 Why Property Registration Matters

Property registration isn’t just a formality—it’s a legal requirement that ensures your rights are protected and the transaction is recorded by the government.

✅ Benefits of Registration:

- Legal ownership and title transfer

- Protection from fraud or disputes

- Required for resale or future mutation

🔄 Note: Registration processes may vary slightly between provinces like Punjab, Sindh, KPK, and Balochistan due to local regulations and digitalization levels.

🏛️ What Is Property Registration?

Property registration is the official recording of the ownership transfer of a property in government land records. It includes stamping, deed writing, biometric verification, and legal validation.

📚 Legal Framework:

- Land Revenue Act, 1967

- Registration Act, 1908

- Stamp Act, 1899

These laws govern property registration, stamp duty, and documentation across Pakistan.

👤 Who Needs to Register Property?

- First-time property buyers

- People inheriting property

- Individuals transferring property through sale, gift, or exchange

- Commercial and residential real estate investors

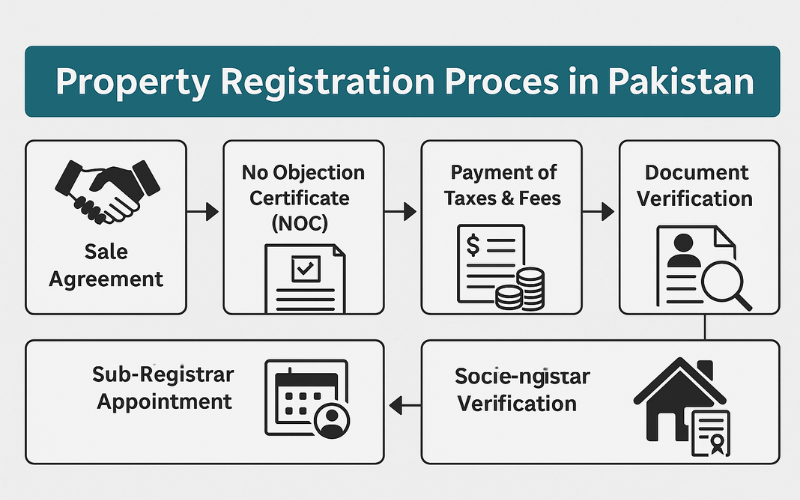

📝 Step-by-Step Property Registration Process

✅ Step 1: Verify Title & Ownership Documents

Before proceeding, ensure:

- Fard Malkiat (Ownership Certificate from Patwari or PLRA)

- Mutation record (Inteqal)

- Seller and buyer CNIC copies

- Original sale deed (if applicable)

- No pending litigation, utility bills, or taxes

✅ Step 2: Prepare the Sale Deed

Engage a registered deed writer or legal professional to draft the Bay Nama (sale deed). This includes buyer-seller details, plot location, price, and payment method.

✅ Step 3: Pay Stamp Duty & Registration Fees

Visit the local Treasury Office or use an e-challan portal (e.g., Punjab eStamp) to pay:

- Stamp Duty: ~1–2%

- Capital Value Tax (CVT): ~2%

- Registration Fee: ~1%

- Withholding Tax: 1% (filers), 2% (non-filers)

💡 Rates vary by location and property type.

✅ Step 4: Visit Sub-Registrar Office

Both parties appear before the Sub-Registrar of Properties, typically located in the Tehsil or District offices. Required documents are submitted, and the sale deed is signed and recorded.

✅ Step 5: Biometric Verification

As per NADRA protocols, both parties undergo thumbprint verification to authenticate identity and avoid fraud.

✅ Step 6: Receive Registered Documents

After submission and verification:

- Documents are officially registered within 7–14 working days.

- You receive a registered copy of the sale deed (proof of ownership).

🏢 Where to Register Property in Pakistan?

✅ Punjab

✅ Sindh

✅ KPK & Balochistan

- Registration handled by local revenue departments; visit respective District Registrar offices.

📲 Some provinces like Punjab offer partial online services (fard verification, e-challan generation).

❌ Common Mistakes to Avoid

- Skipping title verification or relying only on agents

- Buying property without mutation or registered deed

- Not checking for encumbrances, unpaid taxes, or litigation

- Misplacing original documents—registration doesn’t replace ownership proof

💰 Estimated Costs & Taxes (2025)

| Type of Fee | Typical Rate |

| Stamp Duty | 1–2% of property value |

| Capital Value Tax (CVT) | 2% |

| Registration Fee | 1% |

| Withholding Tax | 1% (filer) / 2% (non-filer) |

| Legal/Deed Writer Fee | Rs. 5,000–25,000+ |

Rates vary based on city, property type (urban/rural), and government updates.

🌍 Special Cases

✈️ Overseas Pakistani Registration

- Can register property via Power of Attorney (PoA) attested by Pakistani embassy

- Biometric verification required upon return or via NADRA biometric centers abroad

🏘️ Inheritance Transfers

- Requires death certificate, legal heirship certificate (warasatnama), CNICs

- No sale deed required—mutation via inheritance form

🏢 Residential vs Commercial

- Tax rates and CVT may differ for commercial properties

- Additional approvals may be needed (e.g., municipal NOC)

❓ Frequently Asked Questions (FAQs)

Q1. How long does it take to register property in Pakistan?

7 to 14 working days, depending on the region and documentation completeness.

Q2. Can I register property online?

Partially. You can verify land records and pay stamp duties online in Punjab and Sindh, but final registration still requires physical appearance.

Q3. Is biometric verification mandatory?

Yes, to prevent fraudulent transactions. It is done via NADRA-linked systems at the registrar’s office.

Q4. What happens if I don’t register my property?

Unregistered property does not legally transfer ownership—you may face future disputes, resale issues, or legal penalties.

Q5. How can I check if my property is registered?

Visit the relevant land records authority (e.g., PLRA in Punjab) with your CNIC and property details.

✅ Conclusion

Understanding the property registration process in Pakistan is crucial to protect your legal rights and investment. With the rise of digital tools and stricter verification methods, it’s easier than ever to register land safely and lawfully.

🔐 Pro Tip: Always consult a real estate lawyer or land revenue officer before finalizing any property deal.

Leave a Reply