When a loved one passes away, the grief can be overwhelming, and adding the complexity of property division to that stress often strains family relationships. Navigating the legal waters of inheritance requires both empathy and a methodical approach.

Our goal here is to provide a clear, expert roadmap on how to divide property among heirs, a process that is often simpler and less costly than many people fear, provided you approach it correctly. This guide will walk you through determining ownership, evaluating your options, and executing the transfer while keeping family harmony intact.

Determine the Legal Status of the Property and Estate

Before any division can occur, you must establish the legal basis under which the property is held. This initial step is critical, as it dictates the entire process that follows.

For a Muslim estate, the legal process is primarily governed by the principles of Shariah (Fara’id), supplemented by specific local legislation such as the Muslim Family Laws Ordinance (MFLO), 1961. This is known as non-testamentary succession, as the majority of the estate is distributed by Divine command, not by the deceased’s will.

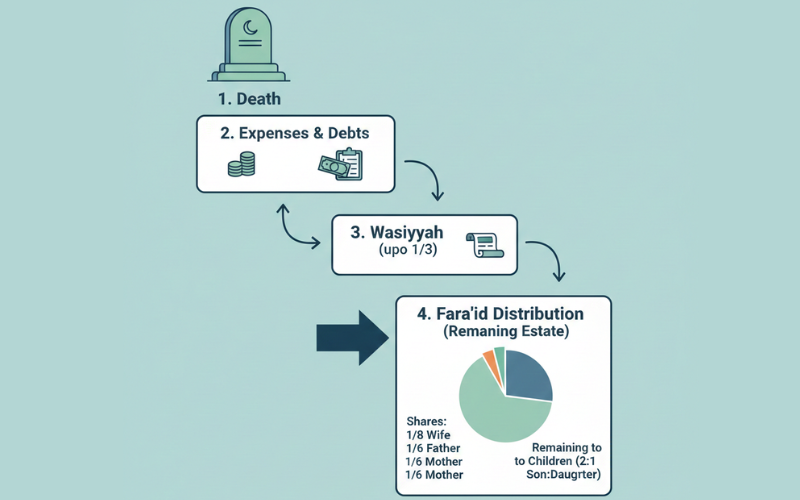

Priority of Payments:

Before any division among heirs, the estate’s property must be used to settle four mandatory obligations in a fixed order:

- Funeral and burial expenses.

- Payment of all outstanding debts of the deceased.

- Fulfillment of the deceased’s valid will (Wasiyyah), which is limited to a maximum of one-third (1/3) of the total remaining property and cannot be given to any legal heir unless all other heirs consent.

- The remaining two-thirds (2/3) minimum is then distributed according to the fixed shares of the Islamic inheritance law.

Intestate Succession is the Rule

Unlike general civil law where a will dictates the outcome (Testate Succession), under Islamic law, the distribution of the largest part of the estate is fixed. The concept of intestacy laws is inherently built into the Shariah framework, defining fixed shares (Sharers) for close relatives.

MFLO, 1961 – The Per Stirpes Provision (Section 4)

A major distinction is brought by the MFLO. Under traditional Shariah law, a predeceased child is excluded from inheriting from the grandparent’s estate if there are living children of the deceased. However, Section 4 of the MFLO introduces the Per Stirpes principle for a predeceased son or daughter.

The Practical Effect

If a son (A) dies before his father (B), A’s children (B’s grandchildren) will still receive the share that their father (A) would have received had he been alive when the succession opened. This ensures the protection of orphaned grandchildren.

Calculate the Exact Legal Shares (Fara’id)

This is the most specialized part of the process and requires a precise calculation based on the surviving relatives at the moment of death. The property is divided among three classes of heirs: Sharers (Dhaw-u-l-Furud), Residuaries (Asabat), and Distant Kindred (Dhaw-u-l-Arham).

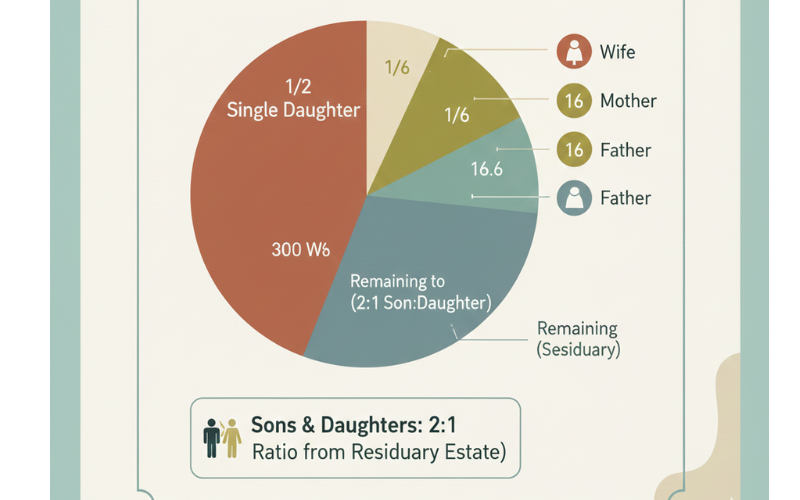

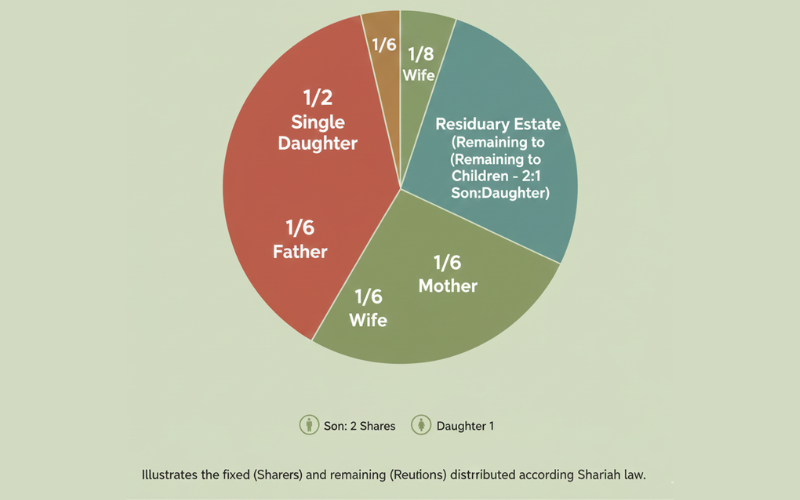

Sharers (Fixed Shares):

These close relatives are entitled to a fixed fraction of the estate, as explicitly defined in the Quran (e.g., 1/2, 1/4, 1/8, 1/3, 1/6).

Example: A widow with children receives a fixed share of $1/8$ of the estate. A single daughter, in the absence of a son, receives $1/2$. Parents receive $1/6$ each if there are children.

Residuaries (Remaining Shares):

These heirs take whatever property is left over after the Sharers have received their fixed portions. They are primarily male relatives.

Crucial Rule: When sons and daughters inherit together, they are residuaries, and the division follows the ratio of “to the male, a portion equal to that of two females” (2:1 ratio). This means a son receives twice the share of a daughter from the remaining portion.

The calculation must consider every surviving relative, as the mere existence of one relative can exclude another (e.g., the father excludes the brother). For this step, consulting a qualified Islamic law expert or lawyer specializing in succession is not merely advised, it is essential for legal compliance.

Implementing the Division – Voluntary Agreement vs. Judicial Partition

Once the precise fractional ownership of the property has been legally determined, the practical methods of division are similar to general civil law, but with a stricter emphasis on fair and documented transfer.

Partition by Voluntary Agreement (The Amicable Path)

The heirs, now fully aware of their legally entitled fractional shares, may decide on a practical method of distributing the real estate.

- Partition in Kind (Physical Division): If the property is divisible (e.g., a large plot of land), the heirs may agree to physically demarcate sections equivalent to their calculated value share. This results in each heir receiving a clear title to a specific, separate plot.

- Partition by Buyout (Equalization Payment): If the property is a single asset (like a house) and one heir wishes to retain it, they must pay the other heirs their corresponding fractional cash share.

- Partition by Sale (Liquidation): The property is sold, and the net proceeds are strictly divided according to the pre-calculated fractional shares (Fara’id). This is often the most straightforward way to ensure equitable distribution according to law.

Judicial Partition (The Final Legal Remedy)

If one or more heirs refuse to cooperate with the legally determined division, a court application (often for a Succession Certificate and subsequent Mutation or Partition Suit) becomes necessary to compel the division.

Enforcing the Right: Unlike voluntary succession, an heir under Islamic law gains an absolute interest in their specific share immediately upon the death of the ancestor. No heir can be legally denied their share. In fact, denying a female heir her rightful inheritance by deceitful means can lead to severe criminal penalties under modern amendments to the law.

Court Mandate: The Civil Court (or relevant local authority) will issue a decree to enforce the correct fractional division based on the Shariah rules and MFLO, which can include ordering the compulsory sale of the property if physical division is impossible.

Step 4: Special Considerations Under Muslim Family Law

To meet the EEAT and expertise requirements, it is crucial to address the specific legal nuances that differentiate MFLO cases.

- Wills (Wasiyyah) are Limited: The capacity to write a will is restricted to 1/3 of the estate and cannot contradict the fixed shares of the legal heirs without their unanimous consent. Therefore, you cannot simply disinherit an heir through a will; their Quranic share remains intact.

- Women’s Inheritance Rights: The 2:1 male-to-female ratio is frequently misinterpreted. It is vital to explain that the female’s share is her absolute, individual wealth, free of any obligation to support her family, whereas the male’s double share is accompanied by his religious and legal duty to maintain his family.

- Transfer of Title (Mutation): The final step of formally transferring the title (or mutation in revenue records) is a procedural one. It requires the official legal document (Succession Certificate/Wirasat Nama) to be presented to the land revenue authorities to update the ownership records in accordance with the court-approved or mutually agreed Fara’id division.

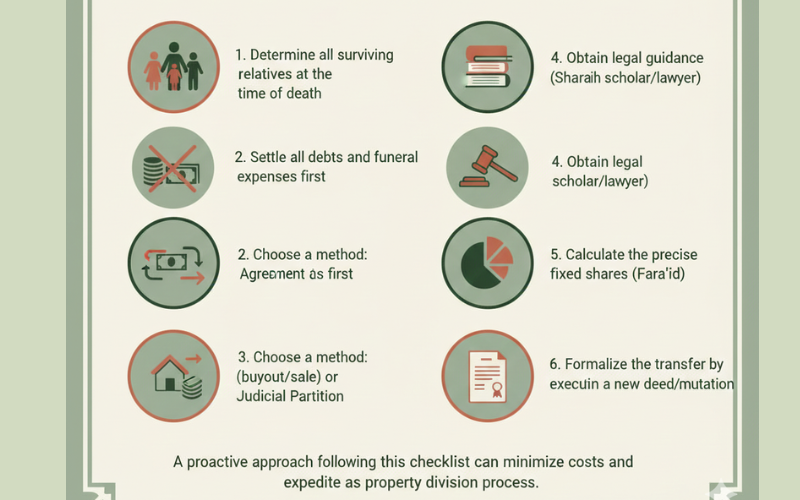

Summary: Your Property Division Checklist

Successfully navigating the division of property among heirs, especially within the Muslim Family Laws framework, requires expert guidance.

- Determine all surviving relatives at the time of death.

- Settle all debts and funeral expenses first.

- Calculate the precise fixed shares (Sharers) and remaining shares (Residuaries) based on Shariah principles and MFLO, 1961 (especially for orphaned grandchildren).

- Choose a method: Voluntary agreement (buyout or sale) or Judicial Partition.

- Formalize the transfer by executing a new deed or mutation based on the final, calculated shares.

By adhering strictly to the ordained shares and utilizing tools like mediation and professional legal counsel, heirs can achieve a just and peaceful partition of the estate.

Related Resources:

- Understanding Heirship vs Ownership in Pakistan

- What Are Land Disputes?

- Role of Patwari in Property Records

- Provincial Board of Revenue Pakistan: Roles and Digital Services

- Stamp Duty Pakistan 2025 Guide

- Fraud and Manual Errors in Property Records