-

Can Agricultural Land Be Converted into a Residential Plot?

Yes, agricultural land can be converted into a residential plot, but only after meeting specific legal conditions and obtaining approvals from relevant authorities. Conversion is generally allowed when land falls near expanding urban limits or…

-

Can Foreigners Buy Agricultural Land in Pakistan? A Complete Legal & Practical Guide

Foreign investment in Pakistan’s real estate and agriculture has grown steadily over the past decade, especially with interest from overseas Pakistanis, Gulf investors, and agri-business firms. This naturally raises a critical question: can foreigners buy…

-

How to Divide Property Among Heirs: A Step-by-Step Guide to Peaceful and Legal Partition

When a loved one passes away, the grief can be overwhelming, and adding the complexity of property division to that stress often strains family relationships. Navigating the legal waters of inheritance requires both empathy and…

-

Power of Attorney (POA) Process for Overseas Buyers in Pakistan

Living abroad while managing property or legal matters in Pakistan often requires a dependable legal arrangement. The Power of Attorney (POA) serves this purpose by allowing overseas Pakistanis to authorize a trusted individual in Pakistan…

-

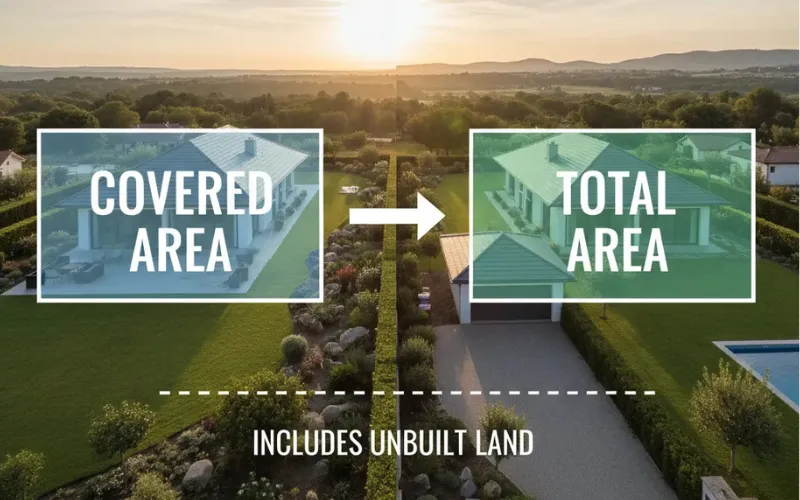

Covered Area vs Total Area in Property: Understanding What Really Counts

Before investing in property, one of the most confusing parts for buyers, sellers, and even builders is understanding what “covered area” and “total area” mean. These terms play a critical role in determining a property’s…

-

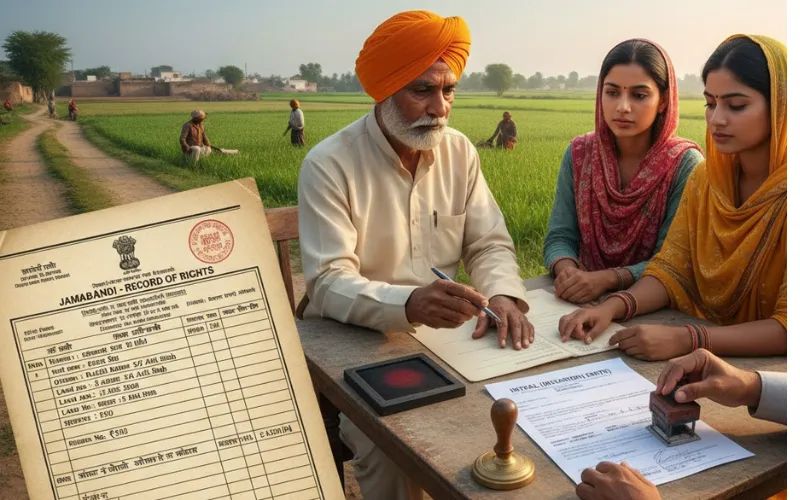

Difference Between Jamabandi and Intkal

Land ownership in Punjab has always been one of the most crucial aspects of property verification. Whether you are buying agricultural land, transferring inheritance, or simply checking family property records, two terms always appear together,Jamabandi…

-

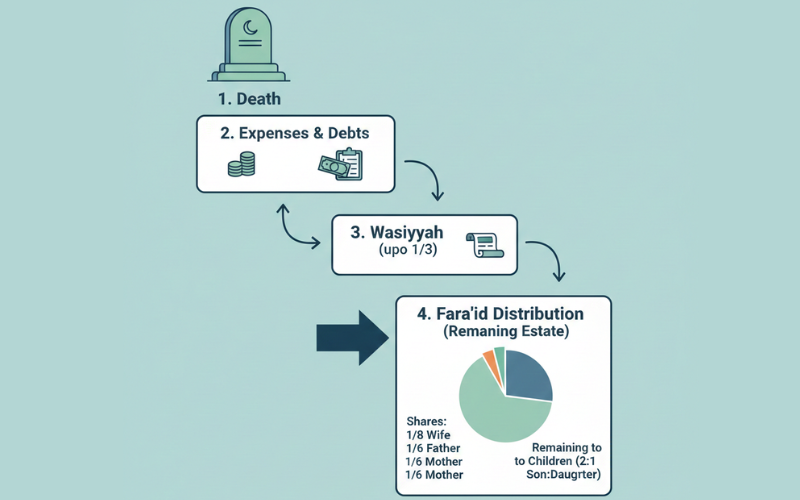

Compulsory Heirs in Pakistan: Inheritance Law Guide

Understanding inheritance rights in Pakistan is one of the most searched family law topics online today. People usually search this query because inheritance disputes are common, estate planning is often misunderstood, and Islamic inheritance law…

-

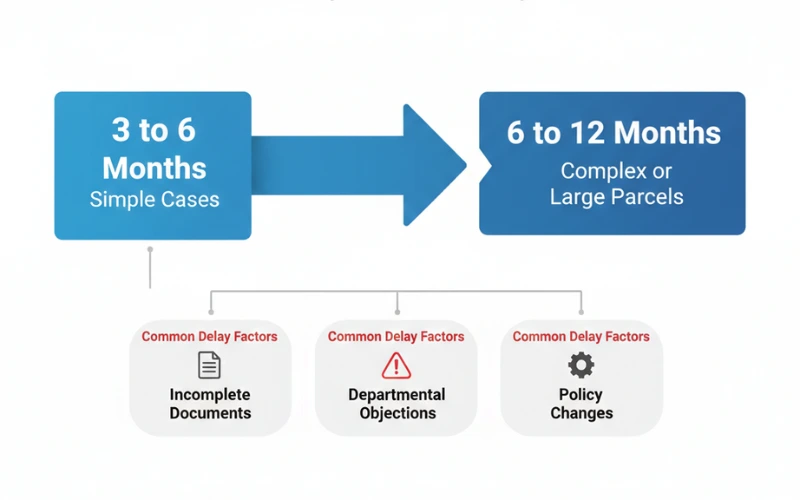

How to Get Construction Approval from Municipal Authority: Step-by-Step Guide

Planning to build a house, office, or commercial building? Before laying the foundation, it’s crucial to obtain construction approval from your municipal authority. This comprehensive guide walks you through the step-by-step process, required documents, common…

-

E-Stamp Paper Verification Process in Pakistan

The e-stamp paper verification process in Pakistan is a critical step for anyone involved in property transactions, legal proceedings, or government documentation. As the country moves towards digitization, verifying e-stamp papers online ensures that your…

-

Actionable Claim under Transfer of Property Act 1882

In Indian property law, an actionable claim under the Transfer of Property Act 1882 (TPA) holds special significance in the transfer of debts and beneficial interests. Though not always tangible, these claims are recognized as…