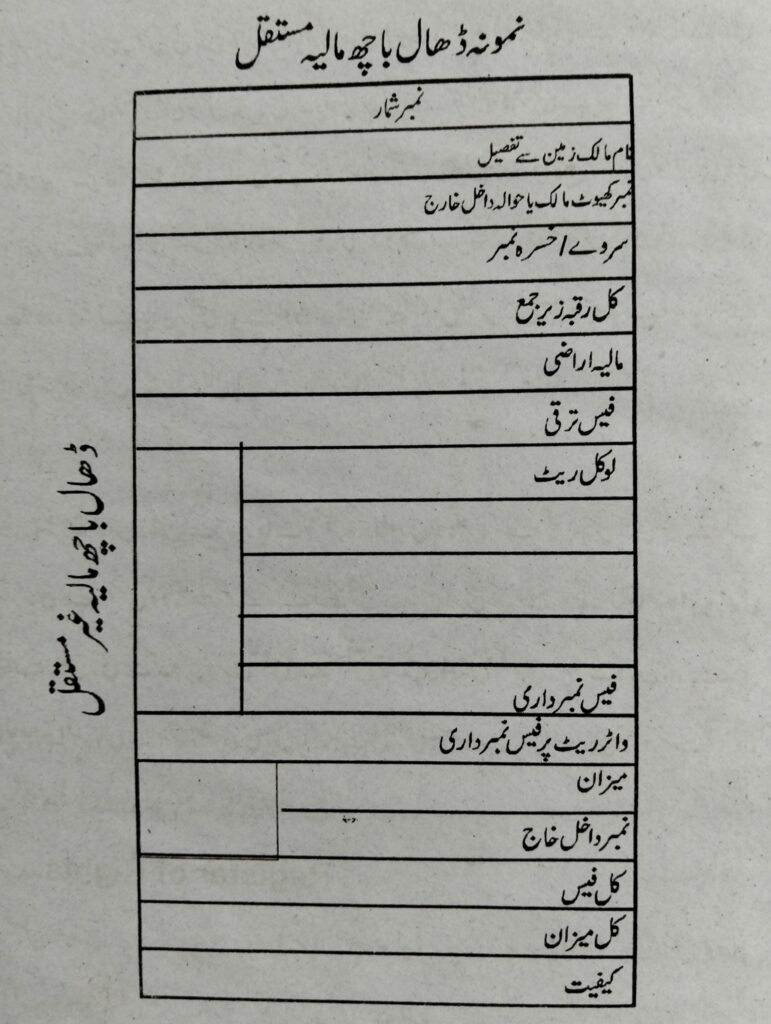

Land management and revenue collection are fundamental aspects of rural administration. Among the various forms of land classification, Dhal Bach Maliya plays a crucial role in ensuring the proper division, assessment, and utilization of agricultural land. It is the responsibility of patwari to ensure accurate land records and guide landowners in understanding the difference between Fixed Dhal Bach Maliya and Temporary Dhal Bach Maliya.

This article provides a detailed overview of these two categories, their legal implications, and the process of documentation and verification.

1. What is Dhal Bach Maliya?

Dhal Bach Maliya refers to the categorization and division of land based on its usage, tenure, and financial obligations. The process of assigning Dhal (land division) and Bach (remaining portion) ensures that land records are systematically maintained, and revenue is collected accordingly.

Dhal Bach Maliya can be classified into two major types:

- Fixed Dhal Bach Maliya (Permanent Land Division)

- Temporary Dhal Bach Maliya (Non-Permanent Land Division)

Each type has distinct purposes, legal frameworks, and procedural requirements that landowners must follow to maintain their land records accurately.

2. Fixed Dhal Bach Maliya: Permanent Land Division

Fixed Dhal Bach Maliya, also known as Permanent Land Division, is executed under Section 56(3), Clause A of the Land Act of 1967. It is a predefined and authorized division of land that remains permanent unless modified by legal means.

Key Characteristics of Fixed Dhal Bach Maliya

- This division is permanent and does not require frequent reassessment.

- Once recorded, it remains a long-term classification for tax and revenue collection.

- It is applicable to regular agricultural land and settled landowners.

- The division is registered and maintained in official Tehsil and Union Council records.

Process of Documentation and Registration

- Assessment and Survey: The land is surveyed by revenue officers and patwaris to determine its classification.

- Landowner Verification: Landowners are required to confirm ownership and land usage.

- Official Record Entry: The Tehsil office registers the land division permanently.

- Issuance of Permanent Certificate: Once registered, a permanent record is maintained, and revenue obligations are assigned accordingly.

3. Temporary Dhal Bach Maliya: Non-Permanent Land Division

Temporary Dhal Bach Maliya, also known as Non-Permanent Land Division, falls under Section 56(3), Clause B of the Land Act of 1967. It is assigned at a predetermined rate and is applicable for short-term agricultural needs.

Key Characteristics of Temporary Dhal Bach Maliya

- It is a temporary classification of land, primarily for seasonal or short-term farming.

- The division remains valid for a limited period (usually four months).

- The classification is subject to reassessment depending on land usage.

- It is mainly used for seed sowing, rotational cropping, or special agricultural needs.

Process of Documentation and Registration

- Survey and Identification: A field survey is conducted to determine whether the land qualifies for temporary division.

- Submission to Union Council: The sowing record is submitted to the Union Council for verification.

- Verification by Landowners: The respective landowners confirm the temporary classification.

- Registration at Tehsil Office: The land record is entered into the revenue system, ensuring transparency in taxation.

- Renewal or Termination: After the designated period, the division is either renewed or reverted to its original classification.

4. Differences Between Fixed and Temporary Dhal Bach Maliya

| Aspect | Fixed Dhal Bach Maliya | Temporary Dhal Bach Maliya |

| Legal Basis | Section 56(3), Clause A | Section 56(3), Clause B |

| Duration | Permanent | Temporary (4 months) |

| Purpose | Regular agricultural land | Short-term farming, seed sowing |

| Record Maintenance | Tehsil Office & Revenue Board | Union Council & Tehsil Office |

| Reassessment Required? | No | Yes, after expiration |

5. Importance of Accurate Land Documentation

For both Fixed and Temporary Dhal Bach Maliya, proper documentation and accurate record-keeping are essential for:

- Ensuring rightful ownership of land and preventing disputes.

- Facilitating legal transactions such as sale, inheritance, or lease agreements.

- Providing transparency in revenue collection, preventing tax fraud or misallocation.

- Enabling landowners to claim benefits, subsidies, or government schemes based on land classification.

Revenue officials and patwaris must work closely with landowners, Tehsil officers, and Union Councils to ensure that land records remain updated and legally compliant.

6. Final Thoughts on Dhal Bach Maliya

The classification of land as Fixed or Temporary Dhal Bach Maliya is a critical process in Pakistan’s land revenue system. Landowners must understand the legal framework, procedural requirements, and financial obligations associated with each type.

Key Takeaways

✔ Fixed Dhal Bach Maliya is permanent, assigned under legal provisions, and does not require reassessment.

✔ Temporary Dhal Bach Maliya is short-term, primarily for agricultural needs, and requires renewal after expiration.

✔ Proper documentation ensures rightful ownership, transparent taxation, and dispute resolution.

✔ Landowners must comply with official regulations to avoid legal issues and ensure seamless transactions.

As a Patwari, I always advise landowners to stay informed about their land classification, maintain up-to-date records, and follow the proper legal channels for land-related matters. Keeping land records accurate and legally compliant protects property rights and ensures fair revenue collection for sustainable agricultural development.

Leave a Reply